Becoming a medical assistant is an affordable way to enter the healthcare field. But before you enroll in a medical assistant program, it’s essential to understand the actual cost of your education and how to manage any student debt you might incur along the way.

Certificate programs typically cost $2,500–$22,000, while associate degrees range from $6,000–$40,000. Graduates incur an average of $10K–$25K in student loan debt—much lower than other healthcare careers—making this a practical and fast-track option with strong job stability and manageable repayment.

Below, we go into further detail about the factors impacting student debt for medical assistants.

Understanding Medical Assistant Education Costs

Medical Assistants have a great career trajectory, allowing for debt to be serviced quickly.

The cost variables of becoming a medical assistant is determined by the following factors:

- the type of school you attend

- public community college or technical school

- private college or medical academy

- whether you live in-state or out-of-state

- the length of your program (certificate vs diploma vs associates degree.

Community colleges and public technical schools are generally less expensive than private career colleges. Shorter certificate programs usually mean less debt than two-year associate degrees.

Certificate and Diploma Programs

Medical assistants can enter the field through either a certificate/diploma program, typically lasting 9–12 months. As you will see, graduates of certificate programs generally incur $10,000–$15,000 in student loan debt, while those with associate degrees average $18,000–$25,000 in debt.

Both options are still substantially lower than the debt required for other healthcare careers.

Community Colleges

A certificate can be low as $2,500 and diploma as much as $10,000.

- Example: Houston Community College (TX): Approx. $3,200 for the full certificate program

Private Institutions

A certificate can be low as $12,000 and a diploma as much as $22,000 at private schools.

- Example: Pima Medical Institute (multiple states): Around $14K for a diploma

Associate Degree Programs

Some students pursue an associate degree, which can open doors to higher pay or more advancement later on. These programs usually take about two years.

Community Colleges

Associate degree programs range from $6,000–$20,000 at public colleges.

Private Institutions

The tuition for associate degrees varies between $20,000–$40,000 at private institutions.

Example: Pima Medical Institute (multiple states): Around $14K for a diploma.

Additional Expenses

Beyond tuition, you’ll also need to budget at least $3,000 for:

- Books and Supplies: $1,000–$2,000 total

- Uniforms and Equipment: $200–$600 for scrubs, stethoscopes, and other tools

- Certification Exam Fees: $125–$250 for exams like the CMA (AAMA) or RMA (AMT)

- Immunizations, Background Checks, CPR Certification: $100–$300

Managing Medical Assistant Student Loan Debt

Choosing affordable schools, applying for scholarships, budgeting carefully, and borrowing only what’s needed can help medical assistants manage their debt and pay it off quickly after entering the workforce.

Here are some important things to consider about repaying loans.

Federal Loan Repayment Plans

- Standard Repayment: 10-year term with fixed monthly payments.

- Income-Driven Repayment: Payments are adjusted based on your income and family size, which can help if your starting salary is modest.

Loan Forgiveness and Assistance

Some states offer loan repayment assistance to medical assistants in underserved areas or public health clinics.

- Federal Public Service Loan Forgiveness (PSLF) may be available if you work for a nonprofit or government employer.

Strategies to Minimize Debt

- Choose Affordable Programs: Look for accredited community colleges or public technical schools with lower tuition.

- Apply for Scholarships: Organizations like the American Association of Medical Assistants (AAMA) and local healthcare foundations offer scholarships ranging from $500–$2,000.

- Budget Carefully: Track your expenses, limit unnecessary spending, and consider part-time work in a healthcare setting for income and valuable experience.

- Borrow Only What You Need: Federal loans have fixed interest rates (currently 8.08% for unsubsidized loans as of July 2024), so minimize borrowing to reduce long-term costs.

See our article about tips to minimize student loan debt.

Repayment Timeframe

The median annual salary for medical assistants is about $44K(BLS). While a higher debt load might limit your options at first, many medical assistants can pay off their loans within a few years of starting work, especially if they keep their living costs in check.

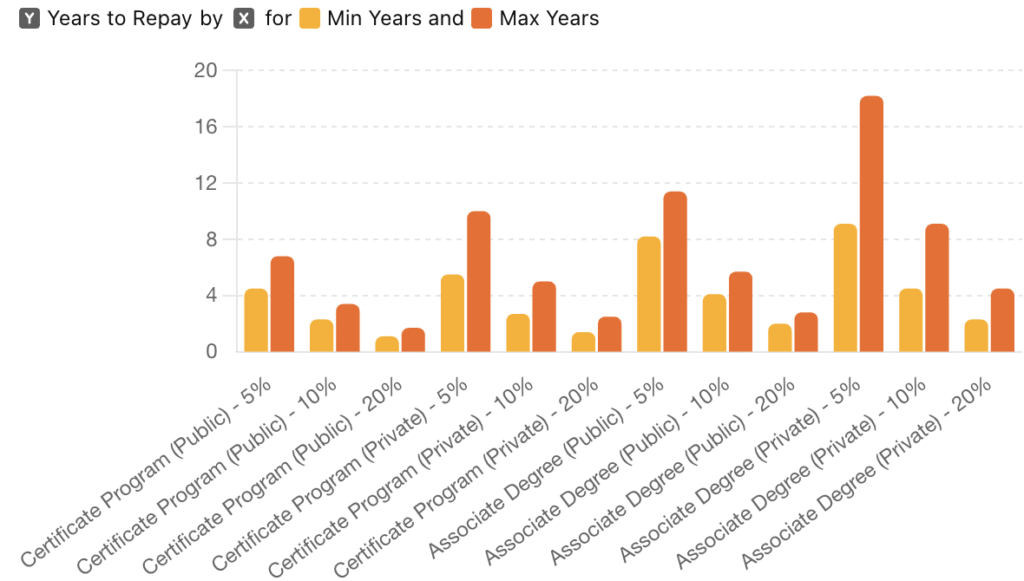

The table below provides some payoff times based on allocating a percentage of a $44K salary to repayment each year.

| Education Type | Payment % of Salary | Min Debt | Max Debt | Years to Repay (Min) | Years to Repay (Max) |

|---|---|---|---|---|---|

| Certificate Program (Public) | 5% | $10,000 | $15,000 | 4.5 | 6.8 |

| Certificate Program (Public) | 10% | $10,000 | $15,000 | 2.3 | 3.4 |

| Certificate Program (Public) | 20% | $10,000 | $15,000 | 1.1 | 1.7 |

| Certificate Program (Private) | 5% | $12,000 | $22,000 | 5.5 | 10.0 |

| Certificate Program (Private) | 10% | $12,000 | $22,000 | 2.7 | 5.0 |

| Certificate Program (Private) | 20% | $12,000 | $22,000 | 1.4 | 2.5 |

| Associate Degree (Public) | 5% | $18,000 | $25,000 | 8.2 | 11.4 |

| Associate Degree (Public) | 10% | $18,000 | $25,000 | 4.1 | 5.7 |

| Associate Degree (Public) | 20% | $18,000 | $25,000 | 2.1 | 2.8 |

| Associate Degree (Private) | 5% | $20,000 | $40,000 | 9.1 | 18.2 |

| Associate Degree (Private) | 10% | $20,000 | $40,000 | 4.5 | 9.1 |

| Associate Degree (Private) | 20% | $20,000 | $40,000 | 2.3 | 4.5 |

Conclusion

Healthcare is a great career choice, and by making the investment into becoming a medical assistant you will be well on your way to a financially rewarding career. By minding your debt and creating a sound financial plan, you will be in a position to pay off your debt quickly and thrive financially.